The New Year has begun! The Christmas tree is down, the festive celebrations have come and gone, and a new semester is just around the corner – and what better way to start the new academic year than by getting your finances in order?

In this guide, we’re taking a look at all things budgeting. What is a budget? What kinds of expenses do you need to consider? And how can you make sure that your budget aligns with your unique lifestyle? We walk you through the answers to these questions and many more below.

What is a budget and why should I have one?

The word budgeting is often associated with restricted spending but, in reality, it’s a way to organise and manage your money. In simple terms, a personal budget is a detailed plan of your income and expenses.

Having a budget doesn’t mean eating two-minute noodles at home for dinner every night to save money. After all, life as an international student should be fun!

Instead of restricting you, budgeting can help you organise your spending more efficiently and potentially save up for a bigger purchase like a holiday with friends.

How to create a student budget

First, you’ll need to calculate your income. Your income is the money that you have coming into your account, which could be in the form of a part-time job, allowance from your parents, or university scholarships.

A simple way to begin is to look at income over a one-month period and list:

- How much income you receive

- How often (is it paid weekly, fortnightly etc.)

Next, you’ll need to calculate your spending over the same month. This may be expenses like:

- Rent

- Groceries

- Bills (e.g. electricity, internet, etc.)

- Subscriptions

- Mobile phone

- Dining out

- Social activities (e.g. trips to the cinema, bars, etc.)

- Travel

- Shopping

Want a little help tracking these costs? Moneysmart offers a helpful budget diary tool, which allows you to input and calculate your expenses.

What should my student budget be?

It’s important to note that the financial requirements for a Student (subclass 500) visa have risen as of October 2023.

International students will need to show evidence of A$24,505 in savings to ensure they can support themselves (an increase from the previous minimum amount of A$21,041). According to the government, the amount was necessarily adjusted to reflect higher living costs.

While this a government-enforced requirement, your day-to-day spending will of course be influenced by your lifestyle, as well as the city or region you live in.

To get a better idea of what you might spend living in Australia, check out our interactive Cost of Living Calculator. Enter your ideal style of accommodation, modes of transportation, study location, and other lifestyle details, and the calculator will generate an estimated cost breakdown.

The top 3 budgeting methods

While there are countless budgeting strategies to consider, let’s take a look at our top three picks for international students.

50/30/20 method

So, you’ve listed your income and expenses. Now you can allocate your future income into categories to organise where you will spend it.

In this method, you spend 50 per cent of your income on your “essential” spending (i.e. rent, groceries and bills).

The next 30 per cent is allocated to your “wants” (i.e. going to bars and restaurants, clothes shopping, etc.)

The final 20 per cent is for your savings. Ideally, you would put this 20 per cent in a high-interest savings account, which is a bank account that helps your money grow by offering interest.

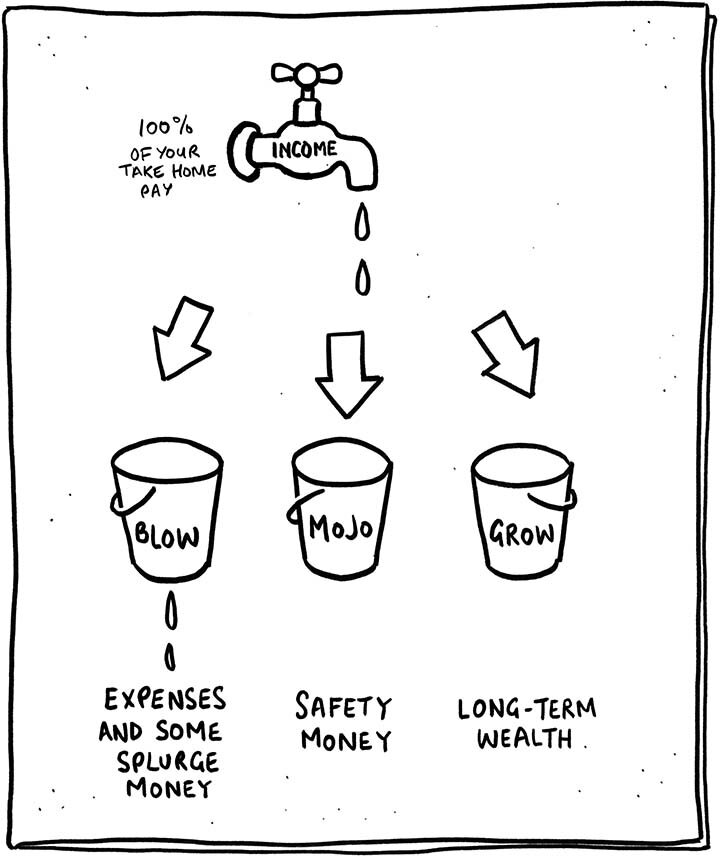

Buckets method

The buckets method is somewhat similar to the 50/30/20 method but allows you to determine your own ratio for each category.

In this strategy, you divide your income into three categories or “buckets”:

- The ‘Blow’ bucket: For daily expenses and the occasional splurge.

- The ‘Mojo’ bucket: To provide some safety/emergency money.

- The ‘Grow’ bucket: To build long-term wealth.

Pay yourself first method

This method is helpful if you have a specific savings goal.

You can calculate how much you need to save each month to reach your goal. When you receive income, you “pay yourself first” meaning you transfer into your savings goal before making any purchases.

Consider this example: Laetitia studies in Sydney and is saving for a trip to Cairns with friends at the end of the year. She estimates she needs $2,000 for her trip.

Laetitia works part-time at a café and earns $300 per week at her job, which means she earns $1,200 per month.

Each month when she is paid, Laetitia immediately puts $200 of her pay into a savings account, which means in 10 months, she will reach her goal of $2,000.

Everyone’s situation is different. Whether you use one of these budgeting methods or develop your own, having the skills to manage your money will allow you to benefit from financial freedom in the long term.

Read more: What I Spend in a Day Living in Melbourne: Living on an International Student Budget