As an international student, if you’re studying in Australia for more than six months, you’ll be regarded as an Australian resident for tax purposes, even if you don’t plan to stay forever.

The good part here is that as a student, you’re entitled to a few Australian resident tax perks such as our tax-free threshold, and typically lower rates than if you weren’t studying!

It’s important to understand the Australian tax system and play by the rules – and this guide will help you do exactly that. Here are the Australian tax basics you need to know!

The basics: What is tax?

Tax is a compulsory payment made to the government, taken from someone’s income, spending or profits. The tax you’re most likely to encounter is income tax.

Income tax is exactly what it sounds like: a tax on (some of) your income. Income includes all of the money you earn from different sources. For example, money from any investments you might make, income from your job, business income and many others.

The Australian Tax Office (ATO) looks at all of the income you earned for the financial year, adds it up and then takes an appropriate portion.

How income tax works

You might be wondering: how much is the Australian Government taking and how do they make sure it’s fair?

The answer to both of these questions lies in the progressive tax system we use in Australia (and that is used in many countries around the world). What this means is that the more money you earn, the higher your rate of tax.

We begin with a tax-free amount, known as the tax-free threshold. This is the highest amount of income you can earn without being required to pay any tax on it. Any amount you earn up to this amount has a 0% tax rate.

Currently in Australia, this threshold is $18,200. So, if you earn $10,000, you pay $0 tax, but if you earn $18,200, you also pay $0 tax.

Note: Your threshold is in direct proportion to how long you’re in Australia (so if you’re only here for six months, your tax-free threshold is only $9,100).

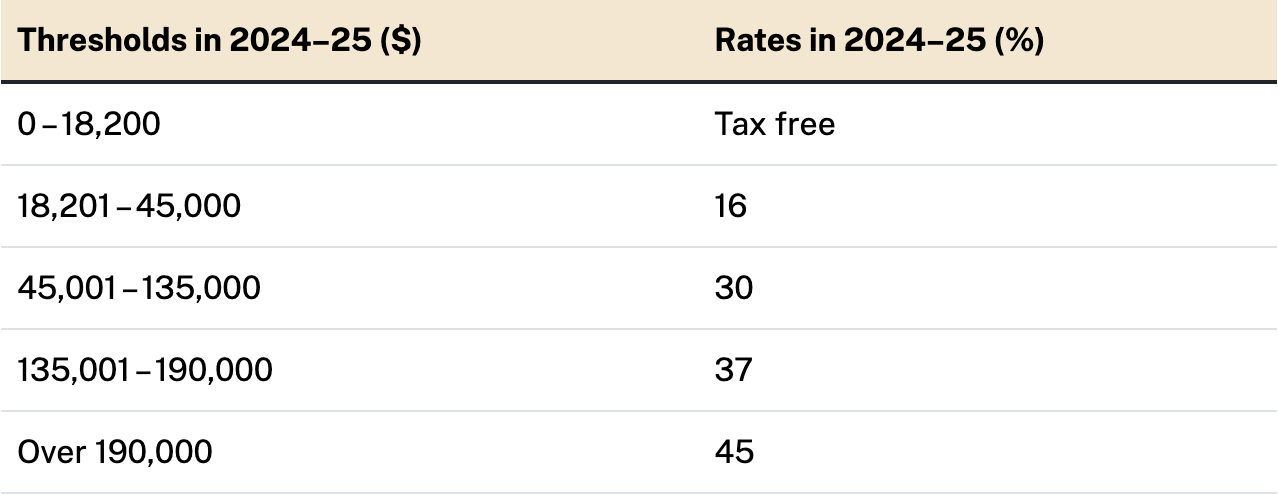

Then, as income gets higher, we start to introduce higher tax rates, which can be found in the table below:

Source: Australian Government

Let’s put this into action!

You can see there’s a 16% tax rate if you earn up to $45,000, and a 30% tax rate after that (up to $135,000).

So, to figure out how much tax you’re going to be paying, you might think, “With these numbers, if I earn $30,000… then I’ll pay $4,800 (30,000 x 16%) in tax?” Well, not quite.

See, the trick is, that tax-free threshold we just introduced applies to everyone for their first $18,200. So, that’s 0% tax on $18,200 and then 16% tax on the remaining $11,800, meaning you’ll actually only pay $1,888 in total tax.

Calculating your tax

As you just learned, the more you earn, the more you pay! The amount you pay is based on the tax bracket your earnings fall under. The maths isn’t that difficult, but the easiest way to do it is by using a tax calculator! This one is super easy to use.

That’s a lot of tax! Do I have to pay all of this?

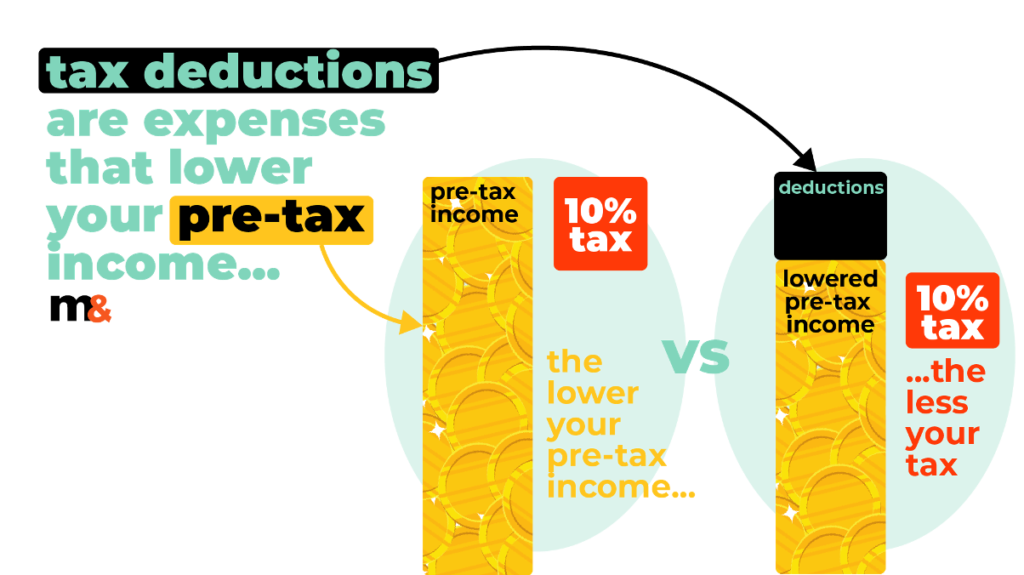

There is a way to reduce the amount of tax you owe through what’s called deductions. Deductions are work-related expenses you can claim to reduce your taxable income. This, in turn, reduces the amount of tax you pay.

Unfortunately, there are limits to what you can and can’t claim as tax deductions. Specifically, tax deductions are for business-related expenses: work uniforms, laptops, a business car, etc. There are specific lists for each job – find out what you might be eligible to claim!

Now that you know the basics, let’s talk about when and how you’ll pay tax…

When do I pay tax?

When it comes to paying your tax, there are two main scenarios:

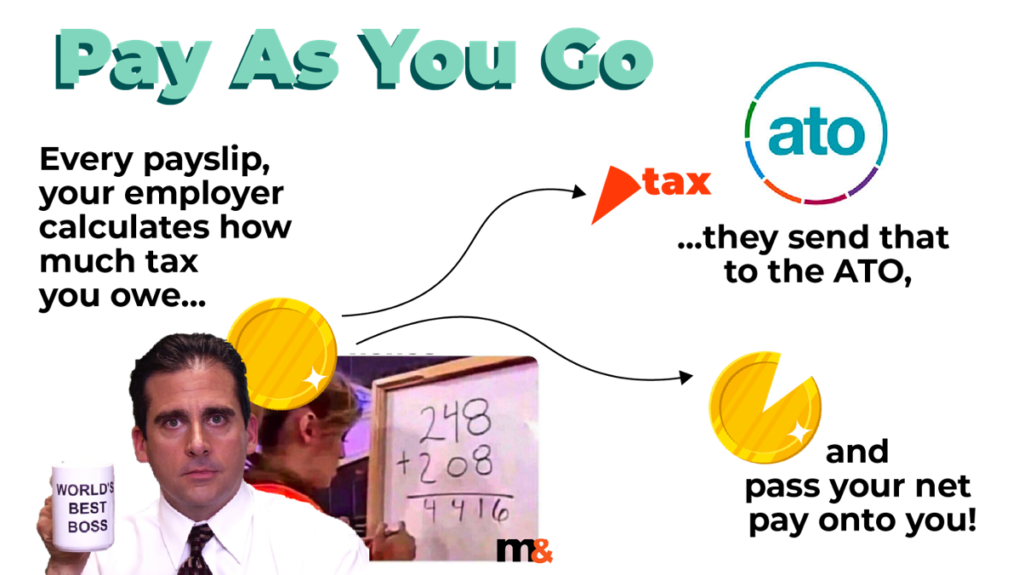

- PAYG (Pay as You Go) – If you’ve registered for PAYG, you’ll be paying tax on each payslip as your employer will take a certain amount out of your earnings and put it towards your tax.

- Not PAYG – If you haven’t registered for PAYG tax, you’ll have to pay all of your tax following the end of the financial year.

How do I do my tax return with an ABN?

If you’re an international student with an Australian Business Number (ABN) and are not registered for PAYG, you may be a little confused about how to do your tax return at the end of the financial year.

An ABN is an Australian Business Number ONLY for people who have a business (i.e. who operate as a sole trader or contractor). Work as a contractor could include sales roles, freelance jobs and sometimes even certain hospitality positions!

It’s extremely important to understand whether your job has you on their records as an employee or a contractor as it affects your tax and pay rights significantly. The main difference is that, as a contractor, you’re the owner of the business. As a result, you won’t fall into the PAYG category and will have to lodge a tax return at the end of the year for all of the income you earn on this business.

In Australia, if you are offered work as a sole trader, you will have to register with the ABR to get your ABN number.

It’s tax return time!

In Australia, the end of financial year is 30 June. A personal income tax needs to be completed between 1 July and 31 October immediately following the end of the financial year.

Tax returns are pretty easy to fill out on your own and can be done via myGov. There’s also plenty of resources out there (including Mandy!) to help you work through your tax return.

If, though, you are someone with an extensive investment portfolio, run your own business, have numerous jobs, or are just still unsure of doing it yourself, the option of help by a tax professional could be worth considering.

It’s definitely a good idea to start your tax return as soon as you can before 31 October, to give you time to deal with any problems and get help if you need it.

Happy tax season!